Watches of Switzerland (LSE: WOSG) shares took a big hit last week. On Friday (25 August), they closed down 21% for the day.

Are they a good buy after this big share price fall? Let’s discuss.

Why the shares fell

The reason the shares tanked last week is that on 24 August, the world’s largest – and most powerful – luxury watch brand, Rolex, announced that it had purchased peer Bucherer, which has around 100 stores worldwide.

This deal could potentially have major implications for Watches of Switzerland Group.

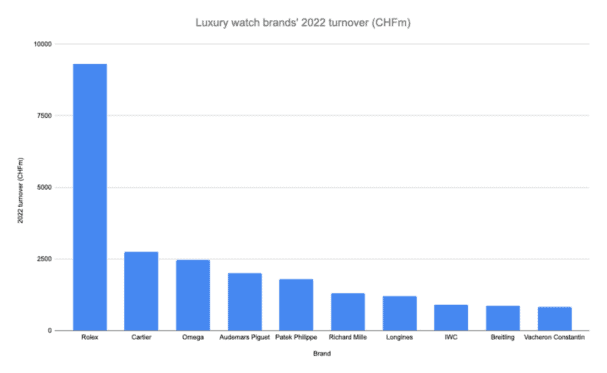

Rolex is the world’s biggest watch manufacturer by revenue (by a mile), as the chart below shows.

Source: Morgan Stanley and LuxeConsult.

And the worry is that the brand – which has always sold watches through ‘authorised dealers’ – could be moving into retail to sell its products direct to consumer. In other words, it could potentially cut out the middleman.

If it was to do this, Watches of Switzerland could be looking at a significant drop in sales.

Now, in a statement published on Friday, the FTSE 250 company commented on the Rolex/Bucherer deal in an effort to ease investors’ concerns.

The company said that:

- This is not a strategic move into retail by Rolex

- There will be no change in Rolex’s product allocation or distribution processes as a consequence of this acquisition

- There will be no operational involvement by Rolex in the Bucherer business

However, investors were clearly spooked by the development.

“Inevitably the market is debating today the extent to which the news signals a growing risk of a weakening future relevance of WOSG to a key supplier for the group,” wrote Jefferies‘ analysts in a research note.

Is now the time to buy?

As for whether the share price fall has presented a great buying opportunity, it’s hard to know, to be honest.

My gut feeling is that Friday’s big drop was an overreaction. And that after the decline, the shares are cheap.

It’s worth noting that analysts currently expect the company to generate earnings per share of 52.6p for the year ending 30 April 2024, which puts the stock on a price-to-earnings (P/E) ratio of about 10.4. That’s quite low.

That said, we can’t rule out the possibility of Rolex moving into retail. There are certainly some reasons this kind of move would make sense.

For a start, it could give the brand more control over who actually receives their watches (which are in high demand at present).

Today, there are rumours that some authorised dealers sell Rolex watches to ‘grey market’ dealers, who then sell them for a higher price on the secondary market. So there are now thousands of brand new Rolex watches on secondary market platforms, such as Chrono24. This is upsetting a lot of genuine watch enthusiasts, who are unable to buy watches at retail prices.

Secondly, a move into retail could significantly boost the company’s profits. According to the New York Times, authorised dealers make a profit of around 40% when they sell a Rolex watch. If the company was to cut out the middleman, its profits would surge.

So there are some very big risks here.

For now though, I’m going to say that Watches of Switzerland shares look quite attractive after the big drop last week.